InnoEnergy marks 2025 as a year of significant progress in driving Europe’s clean industrial transformation. Amid tighter capital markets, InnoEnergy’s portfolio companies closed 76 funding rounds, raising €1.054 billion[1], with multiple ventures reaching key milestones on their growth path.

The turn of the year also brought a leadership transition at InnoEnergy: Effective January 1, 2026, Sébastien Clerc has assumed the role of Chief Executive Officer, succeeding long‑standing CEO Diego Pavía.

Major leaps towards industrialisation in 2025 across the InnoEnergy portfolio

With InnoEnergy’s support, portfolio companies across the clean energy value chain made decisive progress in 2025.

For example,

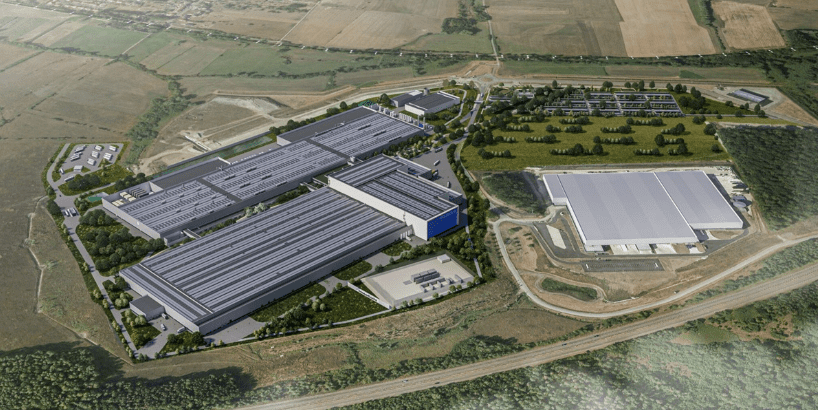

- Battery cell maker Verkor opened its first battery cell gigafactory in Dunkirk, France, representing a major step forward for Europe’s evolving battery value chain. With an initial capacity of 16 GWh/year the factory is expected to reach 50 GWh/year by 2030. The first batteries shall be delivered in 2026.

- GravitHy closed a €60 million Series A, advancing the development of a low-carbon iron production facility near Marseille, France, strengthening Europe’s hydrogen-based industrial supply chains. The plant is expected to produce 2 million tonnes per year of Direct Reduced Iron (DRI) and Hot Briquetted Iron (HBI) from 2029 onwards.

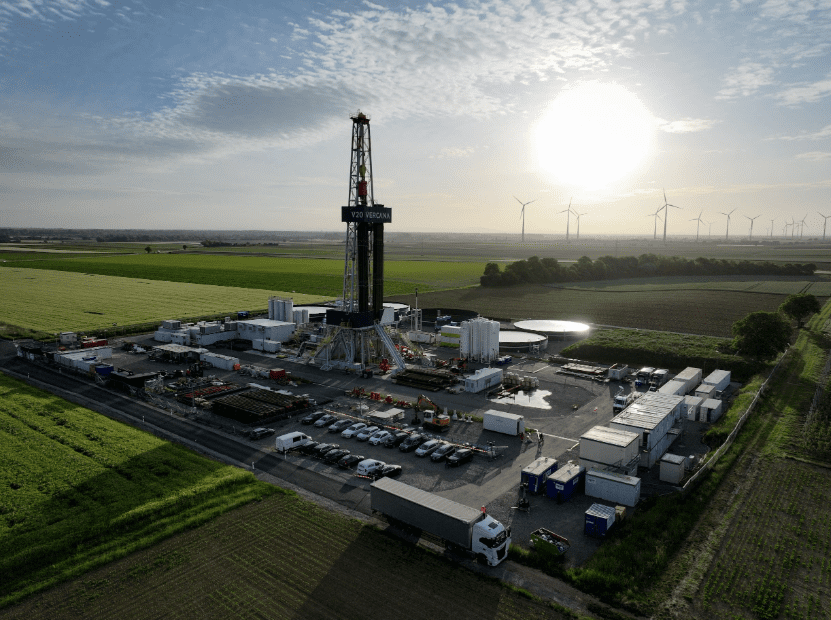

- Vulcan Energy Resources secured €2.2 billion in financing for its Lionheart zero-carbon lithium extraction project in southwest Germany[2], supporting Europe’s ambition to establish a domestic, sustainable lithium supply. Vulcan is targeting a production capacity of 24,000 tonnes of lithium hydroxide monohydrate (LHM) per year.

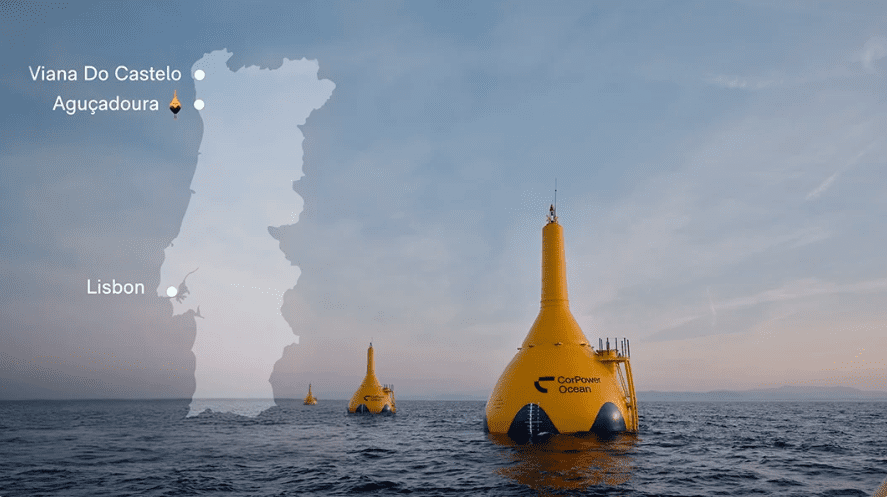

- Wave energy producer CorPower Ocean received €17.5 million from the European Innovation Council Accelerator and secured another €40 million from the European Innovation Fund. The funding will support the development of commercial wave energy farms, including a 10 MW project off the coast of northern Portugal.

- Holosolis raised over €220 million in public and private funding to launch one of Europe’s largest photovoltaic module factories in Sarreguemines, reinforcing efforts to reshore solar manufacturing. The project is set to reach a production capacity of 5 GW per year by 2030.

- European photovoltaic manufacturer Sunwafe has been awarded a €200 million grant by the Spanish government to build Europe’s first large‑scale silicon ingot and wafer plant in Spain with a planned capacity of 20 GW by 2030.

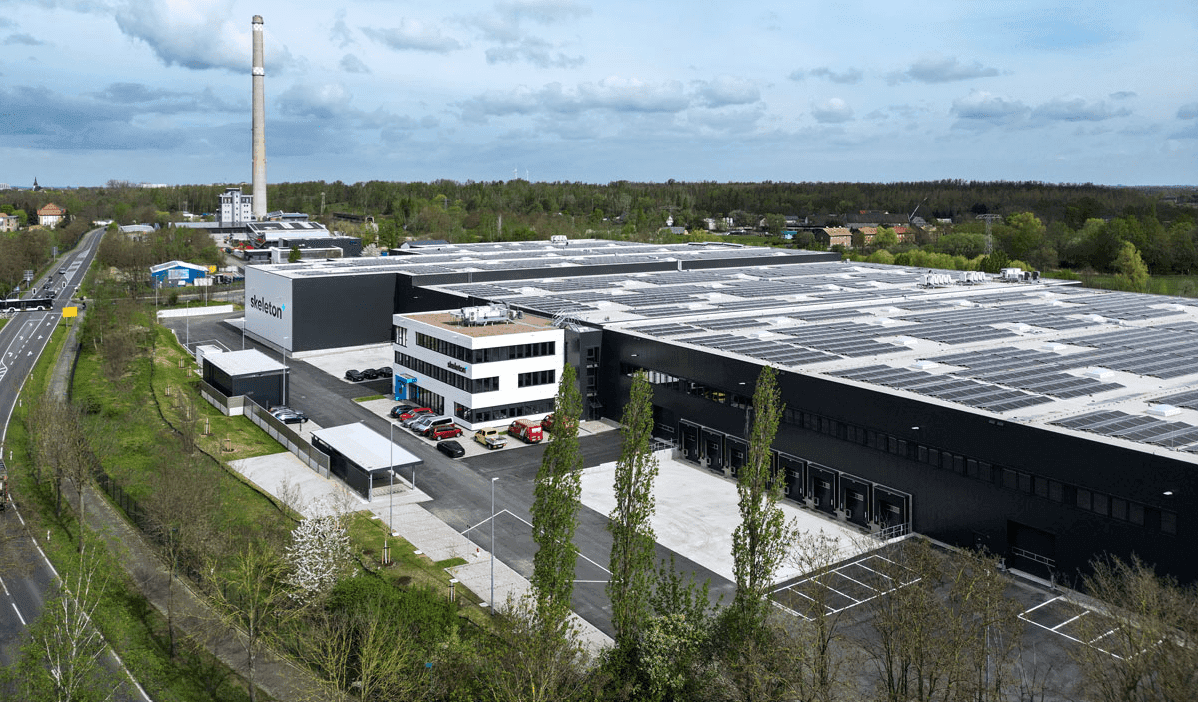

- Skeleton Technologies opened its new supercapacitor factory in Leipzig, Germany with an annual output of up to 12 million cells, and a new 1 GW SuperBattery production facility in Varkaus, Finland, helping stabilise Europe’s power grid and AI-infrastructure.

“2025 showed that scaling is the name of the game”, said Elena Bou, Co-Founder and Innovation Director at InnoEnergy. “The question is no longer whether Europe can turn proven clean technologies into industrial capacity to serve global markets, but how quickly.”

Using the window of opportunity

Europe’s policy framework, reinforced by the Clean Industrial Deal, provides long-term certainty for capital-intensive clean tech projects. In this environment, InnoEnergy continues to build and coordinate industrial ecosystems that de-risk projects and accelerate time to market.

“The strong progress across our portfolio shows that Europe is increasingly being seen as a safe harbour for clean tech investment,” said Sebastian Clerc, CEO of InnoEnergy. “With our ecosystem, we are well-positioned to move fast and scale boldly, seizing this window of opportunity.”

[1] Including only funding raised by non‑listed portfolio companies.

[2] Vulcan Energy Resources is publicly listed on the Australian Securities Exchanges and the Frankfurt Stock Exchange.