In part one: “Building the talent and technology to get Europe to net zero” we explored how clean tech industrialisation starts with people, innovation, and an ecosystem that can scale ideas into industry. Moving from talent and industrialisation to geopolitics and strategic autonomy, we then heard from Javier Solana, former NATO Secretary General and President of the Esade Center for Global Economy and Geopolitics, who said:

“Ultimately, the future of energy will be decided by the choices we make today, where and how we innovate, and with whom we cooperate. Without a doubt, our goal should be to invest in an energy system that isn’t only sustainable, but also secure, resilient, and prepared for the geopolitical uncertainties of the decades ahead.”

To delve into this topic further, Diego Pavía (CEO, InnoEnergy) moderated a panel with Yun Luo (CEO of solar panel recycling pioneer ROSI) and Lucas Arangüena (Chief Data and AI Officer at Santander Corporate and Investment Banking), to discuss how to turn pressure into bankable, industrial-scale projects.

“Clients need to be net zero by 2050”

With Europe still importing two-thirds of the energy we use, about 90% of that being fossil fuels, progressing towards independence will mean doubling down on what we have: renewable energy. Speaking on capital flows, Santander’s Lucas Arangüena made a bold statement: “All our clients will need to be net zero by 2050.” For a loan book north of a trillion, that re-wires incentives across the whole economy. He also explained why the toolkit is broader now. Banks will structure debt, provide growth equity, and build bespoke solutions when technology risk is low and commercial pathways are clear.

For context, in 2022, Santander provided InnoEnergy’s first balance-sheet debt facility, proof that well-structured platforms are bankable. “We analysed the risks we were taking and how to mitigate them. That’s at the core of what the European financial system is trying to do: tailor‑make solutions for difficult problems,” added Arangüena.

Industrialising circular PV at scale: “We’re looking at a €4 billion market by 2030 and an €80 billion market by 2050”

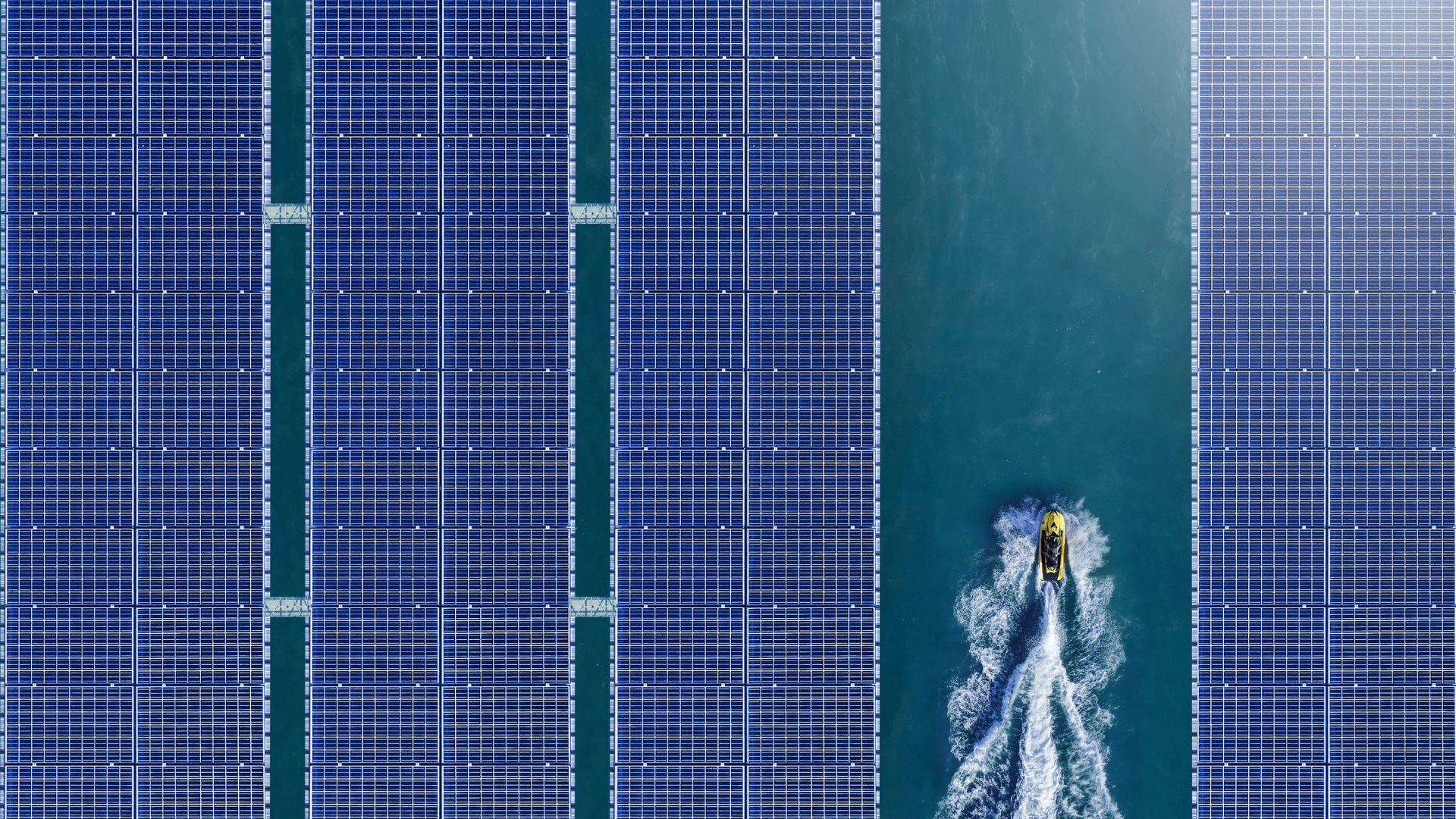

Nothing illustrates “innovation sparks it, investment fuels it, industry builds it” better than ROSI. CEO Yun Luo clearly laid out the economics of solar recycling. By the end of 2024, Europe’s repowering wave will have generated roughly 100,000 tonnes of PV modules to recycle per gigawatt, with a €4 billion market by 2030 and €80 billion by 2050. Critically, incoming regulation mandating recycled content in new panels creates a durable, European demand signal, which is exactly the condition financiers need.

And ROSI’s scale-up path is an inspiring example of a vision of industrialisation: a 3,000-tonne/year industrial demonstrator in France (~€6 million capex) expands to 5,000 tonnes; Spain follows with 10,000 tonnes (~€10 million capex); and Germany is planned at 30,000 tonnes (~€20 million).

As capacity rises, capex efficiency improves, about five times more capacity for roughly three times the capex. That’s the kind of learning curve industrial investors recognise. “Our task as a technology company is to provide evidence for regulators, so they can put in place the right rules to accelerate industrialisation. It’s a win‑win,” says Yun.

Strategically, ROSI is stitching together a closed, circular European PV value chain, recovering high-purity silicon and silver back into batteries, chemicals, semiconductors and PV, and partnering with manufacturers such as Holosolis.

“We’ve followed a classic industrialisation route. First, we prove the quality of the process; then we design and adapt machinery to realise those processes at a small scale; then the next scale, and the next, step by step. InnoEnergy has always been close throughout,” adds Luo.

Why this matters for Europe’s competitiveness

Beyond technological breakthroughs, Europe’s ability to compete will depend on mobilising capital quickly and proving that clean technologies can scale profitably.

“It’s now about industrialisation and bringing unit costs down. Large infrastructure and climate funds raised in recent years are struggling to find good assets. In Europe, many of those golden nuggets are in our backyard, and InnoEnergy has done a great job identifying and scaling them. For technologies that are profitable, the capital pools are there,” says Santander’s Lucas.

“We can say we have the chance here in Europe first, for a closed, circular PV value chain.”

There are tremendous opportunities for value creation in clean tech. Geopolitics has raised the stakes. However, industrial players like ROSI demonstrate how circularity can be a competitive advantage.

“This is our big ambition. We started at a place that nobody does in this world. And that is to recover the raw materials, critical raw materials, especially silicon and silver, back to industry. We have the chance here in Europe to be first, for a closed, circular PV value chain,” adds Yun.

Watch the full conversation in the video recording below.